Invoicing for contracted services

When you sign a contract with our Vocational Rehabilitation Services team, your contract agreement explains how to invoice us for your services. Following these instructions will enable us to pay you sooner. Some of you can use our Provider Portal to submit your invoice and any necessary reports, and to check on your payment status.

When we send our contracted providers a referral for service, it also serves as our approval for the work. The referral includes the worker's details, specifics about the services requested, and contact information for the vocational rehabilitation consultant who has made the referral.

Please refer to this table when invoicing us for your services. It tells you whether you should invoice electronically through our Provider Portal or My Provider Services, or by mail or fax using our invoice forms.

| Contract | Invoice Method |

|---|---|

| Class 1-4 Commercial Driver/HEO assessment | Provider Portal (No invoice form is required) |

|

Job Search Support Services

|

Provider Portal (No invoice form is required) |

| Psychological-vocational Assessment | Provider Portal (No invoice form is required) |

| Vocational Interest and Aptitude Testing | Provider Portal (No invoice form is required) |

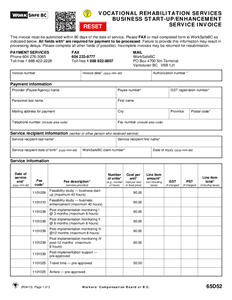

| Business Feasibility Study | Submit Form 65D52 by mail or fax or use My Provider Services |

| Class 1-4 Commercial Driver Training | Submit Form 65D52 by mail or fax or use My Provider Services |

| Job Search Support Services EDAP | Submit Form 65D52 by mail or fax or use My Provider Services |

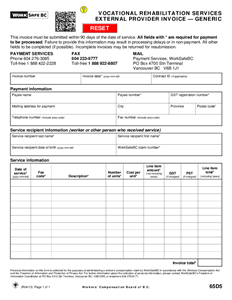

If you're invoicing using our invoice template, please submit a hardcopy by mail or fax. Our fax number and mailing address appear at the top of the invoice templates.

If you need help using the Provider Portal, call our support team toll-free at 1.855.284.5900.

Be sure to include the following information on your invoices:

|

Information required |

Notes |

|---|---|

|

Invoice date |

Make sure your invoice is not post-dated |

|

Payee number |

This is in your contract with us. If your firm uses more than one payee number, be sure to use the correct one. |

|

GST registration number |

Only if applicable |

|

Postal code |

Your postal code |

|

Worker’s name |

Name of the service recipient |

|

Invoice number |

This is important as it allows you to check your invoice status online |

| Service information | Notes |

|---|---|

|

Date of service |

Next to each item, list the date you finished delivering the service. This date must not be after the invoice date. |

|

Fee item description |

This should correspond to the specific service requested in the referral you received |

|

Fee codes |

These are listed in your contract |

|

Item amount or unit price |

Your contract specifies the appropriate rate |

|

Taxes |

Indicate next to each line item if the GST and-or PST apply |

If you're using the Provider Portal to bill us, it will automatically list your payee number, GST number, postal code, and the worker's name, date of birth, and claim number. But be sure to fill in all the other fields.

Most invoices for contracted services can't be paid until we receive your final report. You can check your contract to see what reports we require. Send in your final report before submitting your invoice. It's important for the date of service on your report to match the date of service on your invoice.

Learn more about the reports required for assessment services, job search support services, and other contracted services.